Introduction: Understanding the Importance of Investment Portfolio Tracking

Understanding the importance of investment portfolio tracking is crucial for successful financial management. By utilising investment tracking software and portfolio management tools, investors can effectively monitor their investments and make informed decisions.

Disclosure: If you click on my affiliate/advertiser’s links, I am going to receive a tiny commission. AND… Most of the time, you will receive an offer of some kind. It’ s a Win/Win!

Investment tracker apps have become increasingly popular as they provide real-time updates on the performance of various assets within a portfolio. This allows investors to track their investments closely and adjust their strategies accordingly.

Effective investment monitoring through portfolio tracking not only helps in assessing the performance of individual assets but also aids in diversification and risk management. By staying informed about market trends and asset performance, investors can optimise their portfolios for long-term growth and stability.

Benefits of Using Investment Portfolio Tracking Tools for Financial Success

Investment portfolio tracking tools play a crucial role in helping individuals achieve financial success by providing valuable insights and data on their investments. These tools, such as portfolio tracker apps and investment monitoring software, enable users to efficiently manage their stock portfolios and asset allocation.

By utilising digital investment monitoring tools, investors can easily track the performance of their investments in real-time, analyse trends, and make informed decisions based on accurate data. This helps in optimising asset allocation strategies and maximising investment returns.

An investment portfolio tracker is a software tool or platform designed to help investors monitor and manage their investment holdings. It allows users to input information about their various investments, such as stocks, bonds, mutual funds, ETFs (Exchange Traded Funds), and other assets, and then tracks the performance and value of these investments over time. The tracker typically provides analytics, performance metrics, and sometimes advanced features like tax reporting and benchmarking against market indices.

Whether it’s monitoring individual stocks or evaluating the overall performance of a diversified portfolio, these investment tracking tools offer convenience and efficiency in managing one’s financial assets. Embracing technology through the use of asset allocation tools can lead to better financial planning and ultimately contribute to long-term financial success.

Top Features to Look for in an Effective Investment Portfolio Tracking System

When considering an investment portfolio tracking system, it is essential to look for certain key features that can enhance your investment management experience. The best portfolio tracking tools offer a range of functionalities to help you monitor and analyse your investments effectively.

Online investment trackers should provide real-time updates on your portfolio performance, including stock market movements and asset allocation. Look for a system that offers comprehensive reporting capabilities, allowing you to track the performance of individual investments and overall portfolio growth.

The best portfolio tracking apps often include features such as customizable alerts for price changes, news updates related to your investments, and the ability to sync with multiple accounts for a holistic view of your financial holdings. Additionally, online portfolio trackers with user-friendly interfaces and mobile accessibility can make managing your investments more convenient and efficient.

Advantages of using investment portfolio tracker software

The advantages of using an investment portfolio tracker software include:

1. **Consolidation of Investment Data**: Investors can consolidate all their investments in one place, providing a comprehensive overview of their portfolio.

2. **Real-Time Updates**: Most portfolio trackers offer real-time updates on the performance and value of investments, allowing investors to make informed decisions promptly.

3. **Performance Analysis**: Users can analyse the performance of individual investments as well as the entire portfolio, helping them understand where they stand financially and make adjustments accordingly.

4. **Diversification Monitoring**: Portfolio trackers can help investors ensure they have a well-diversified portfolio by analysing asset allocation and providing insights into potential areas of overexposure or underexposure.

5. **Tax Reporting**: Some portfolio trackers offer tax reporting features, which can simplify the process of preparing tax documents and identifying tax-efficient investment strategies.

6. **Goal Tracking**: Investors can set financial goals and track their progress over time, helping them stay focused and disciplined in their investment approach.

Tips and Tricks for Efficiently Tracking and Analysing Your Investment Portfolio

Efficiently tracking and analysing your investment portfolio is crucial for making informed decisions and maximizing returns. By implementing effective investment tracking strategies, investors can stay on top of their portfolios and identify trends that may impact their investments.

Utilizing investment analysis tools and stock market analysis software can provide valuable insights into portfolio performance. These tools can help investors monitor their investments, track market trends, and assess the overall health of their portfolios.

In addition to using technology, maintaining an investment tracking spreadsheet can be a useful way to organize and analyse your investments. By regularly updating this spreadsheet with relevant data, investors can gain a comprehensive view of their portfolio’s performance over time.

By combining these techniques and staying proactive in monitoring your investments, you can make more informed decisions and ultimately achieve your financial goals.

The Best Investment Portfolio Tracking Apps and Software Available in the Market Today

When it comes to managing your investment portfolio, having the right tools can make a significant difference. In today’s market, there are several investment tracking apps and software options available that cater to different needs and preferences.

Investment tracking apps have become essential for investors looking to monitor their portfolios on the go. These apps provide real-time updates on stock prices, performance metrics, and news alerts to help users make informed decisions.

In 2024, top portfolio management apps offer advanced features such as customizable dashboards, portfolio analysis tools, and integration with financial institutions for seamless data syncing. Investors can track their investments across various asset classes and receive insights into their overall performance.

Some popular investment portfolio tracker options include:

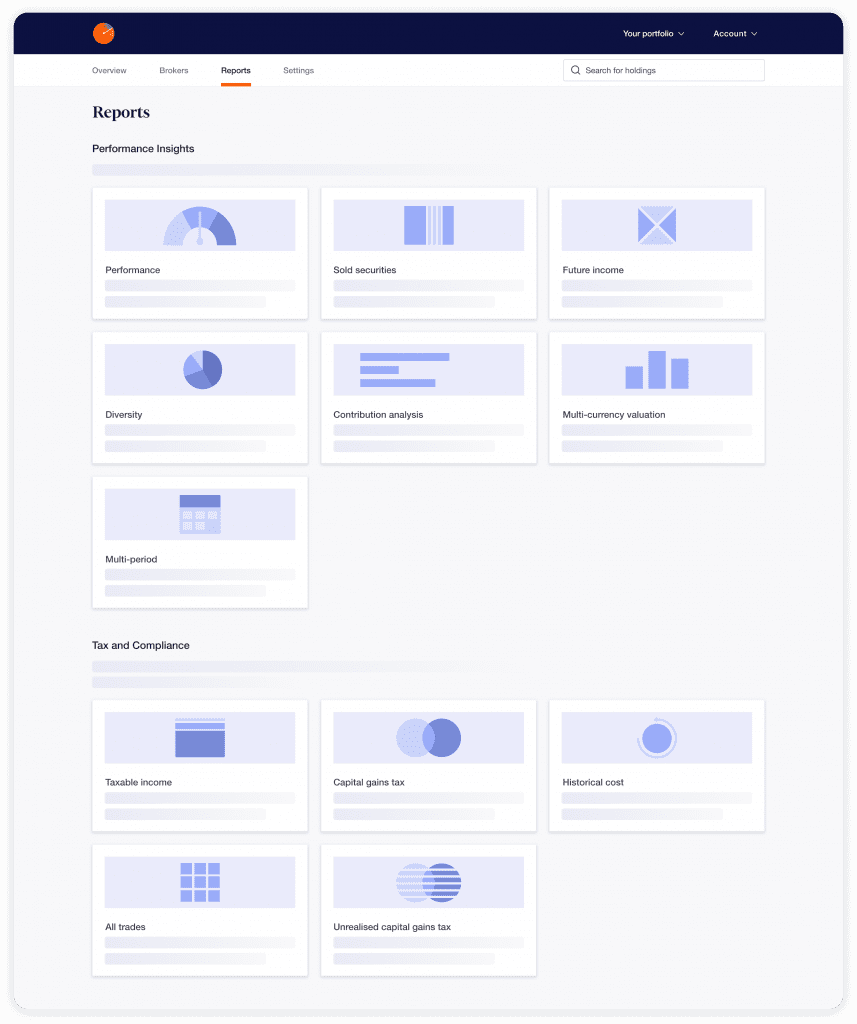

1. **Sharesight**: Sharesight is a cloud-based portfolio tracker that offers a range of features including performance tracking, dividend tracking, tax reporting, and benchmarking. It supports various markets worldwide and integrates with many brokers and financial institutions.

2. **Morningstar Portfolio Manager**: Morningstar offers a portfolio tracking tool that provides performance analysis, investment research, and portfolio optimization features.

3. **Personal Capital**: Personal Capital offers a comprehensive suite of financial tools, including an investment portfolio tracker, retirement planner, and budgeting tools. It also provides access to financial advisors for a fee.

4. **Yahoo Finance**: Yahoo Finance offers a basic portfolio tracking tool that allows users to track their investments and access market data and news.

My personal first choice is Sharesight. But don’t just take my word for it! Here’s a YouTube video review of it:

https://www.youtube.com/watch?v=N6kkewz7gLc

Sharesight is well established, having already been 15 years in the FinTech SaaS industry. Over 400k investors worldwide trust and use Sharesight. It has over 200 software, broker & partner integrations. So really, it is a tool that most individuals, or organisations can use.

Compared to the others, Sharesight’s advantages include:

– **Comprehensive Features**: Sharesight offers a wide range of features including performance tracking, dividend tracking, and tax reporting, making it suitable for both individual investors and professionals.

– **Global Coverage**: Sharesight supports various markets worldwide, making it a suitable option for investors with international investments.

– **Integration**: Sharesight integrates with many brokers and financial institutions, allowing for automatic data import and synchronization.

However, some potential drawbacks of Sharesight include:

– **Cost**: Sharesight‘s pricing structure may be relatively higher compared to some other portfolio tracking options, especially for users with larger portfolios or those requiring advanced features.

– **Learning Curve**: While Sharesight is user-friendly, some users may find it takes time to learn how to fully utilize all of its features and capabilities.

Ultimately, the choice of an investment portfolio tracker depends on individual preferences, investment goals, and the specific features and functionality required. Sharesight may be a suitable option for investors looking for a comprehensive portfolio tracking solution with robust features and global coverage, but it’s essential to compare it with other options to determine which best meets your needs.

Whether you are a beginner or an experienced investor, choosing the best stock tracker app or investment management platform can streamline your portfolio monitoring process and enhance your investment strategy. Stay updated with the latest trends in popular stock tracking apps to ensure you have access to the most relevant tools for managing your investments effectively.

Conclusion: Take Control of Your Investments with the Right Portfolio Tracking Solution

In conclusion, taking control of your investments is crucial for financial success. By utilising effective investment portfolio tracking strategies and tools, you can monitor and manage your investments more efficiently. This proactive approach allows you to make informed decisions, adjust your portfolio as needed, and ultimately work towards achieving your financial goals.

Choosing the right portfolio tracking solution is key to effectively managing your investments. By leveraging the power of technology and data analysis, you can gain valuable insights into your portfolio performance, identify trends, and make strategic investment decisions.

Remember, taking control of your finances with the right portfolio tracking solution empowers you to navigate the complexities of the financial markets with confidence and clarity. Stay informed, stay proactive, and take charge of your financial future today!

USA TODAY Network is a subscription-led media and marketing solutions company, delivering unparalleled national and local reach, Pulitzer-Prize winning content, unbiased perspectives, and unlimited access to everything from sports to news on all devices.